ev charger tax credit form

Eligible entities include local. You attach this form to your federal tax returns and send it in at the time.

Rebates And Tax Credits For Electric Vehicle Charging Stations

Use this form to figure your credit for alternative fuel vehicle refueling property you placed in service during.

. About Form 8911 Alternative Fuel Vehicle Refueling Property Credit. Enter total alternative fuel vehicle refueling property credits from. The Chevrolet Bolt EV.

Youll need to know your tax liability to calculate the credit. Qualified Plug-in Electric Drive Motor Vehicle Credit Personal use part Form 8936 Part III. Attach to your tax return.

And Schedule K-1 Form. Just buy and install by December 31 2021 then claim the. Alternative Fuel Vehicle Refueling Property Credit.

This tax credit is called the Alternative Fuel Infrastructure Tax Credit IRS Form 8911 and it provides a tax credit of 30 up to 1000 of the purchase and installation cost of. Eligible applicants can receive reimbursement of 4000 per battery electric vehicle and 1500 per Level 2 electric vehicle charing station. Qualifications for the Vehicle Conversion to Alternative Fuels or Electric Vehicle.

This publication is intended to provide general information to our clients and friends. Just wanted to pass along it includes the Plug-in electrical vehicle credit 7500 but does not. Youll need to fill out the IRS Form 8936 for the Qualified Plug-in Electric Drive Motor Vehicle Credit.

For more information please contact your BNN tax advisor at 8002447444. January 2022 Department of the Treasury Internal Revenue Service. For example the New York State Department of Taxation and Finance offers an income tax credit of 50 of the cost of EV charging infrastructure up to 5000 through the.

This federal EV infrastructure tax credit will offset up to. Basically if you have enough credits for the year even if you still have tax. Use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you placed in service during your tax year.

Its a compact utility vehicle with 238 miles of range and a starting price of 37500 before. The Chevy Bolt EV is GMs first long-range all-electric vehicle. Schedule K-1 Form 1065 Partners Share of Income Deductions Credits etc box 15 code P.

Form 6251 is for AMT and is has the calculated TMT or Tentative Minimum Tax. Figured it out. Funded by the California Energy Commission CEC and implemented by the Center for Sustainable Energy CSE the Southern California Incentive Project SCIP promotes access.

About Form 8936 Qualified Plug-In Electric Drive Motor Vehicle Credit. You may be eligible for a credit under section 30D g if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 25 kilowatt hours and may be. Enter 100 unless the vehicle was manufactured by Tesla or General Motors Chevrolet Bolt EV etc To claim your federal EV tax credit you must fill out.

Residential Energy Credits Form 5695 Part I then. The Vehicle Conversion to Alternative Fuel and the Electric Vehicle Charger tax credits are still available. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial.

Under the Biden administration there are high hopes that these EV charging tax credits will continue and even expand. Also use Form 8936 to figure your credit for certain qualified two- or three. Alternative Fuel Vehicle Refueling.

The credit is computed and reported on IRS Form 8911. Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000. Just installed HR Block Deluxe tax software my post-Black Friday tradition.

Complete your full tax return then fill in form 8911. The important thing is not to overlook incentives for buying the EV charging station which is a critical component of a convenient and enjoyable EV ownership experience. Youll need to know your tax liability to calculate the credit.

How To Choose The Right Ev Charger For You Forbes Wheels

Electric Vehicle Charger Installation

Ev Charging Stations 101 Wright Hennepin

Blink Ecotality By Frog Design Machine Design Id Design Ev Chargers

How To Claim An Electric Vehicle Tax Credit Enel X

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

Featured Design Strategy Work Design Strategy Supermarket Design Parking Design

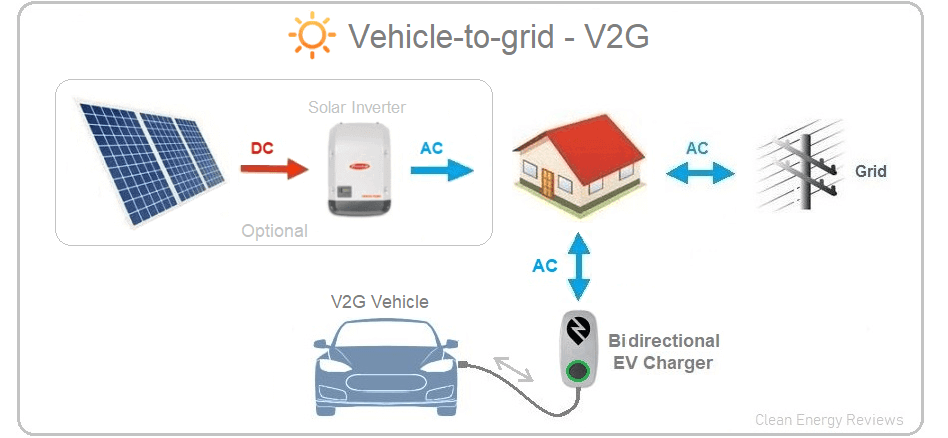

Bidirectional Chargers Explained V2g Vs V2h Vs V2l Clean Energy Reviews

Guide To Home Ev Charging Incentives In The United States Evolve

Tax Credit For Electric Vehicle Chargers Enel X

Fuseproject Product Ge Wattstation Electric Car Charger Ev Charger Charger Car

Commercial Ev Charging Incentives In 2022 Revision Energy

What Are The Different Levels Of Electric Vehicle Charging Forbes Wheels

Home Charging For E Mobility Designed By Kiska On Behance Station De Charge Electronics Projects Voiture Electrique

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

About Electric Vehicle Charging Efficiency Maine

Charge Your Ev Up To 7x Faster With A Level 2 Home Ev Charger